Martha's Vineyard Home Buying Resources

6 Steps to Home Buying

The process of buying a home can be complicated and tedious, especially if you are a first-time buyer. The process does get easier with familiarity, but each sale is unique and creates its own story. However, you can arm yourself with information so to make the process go more smoothly. Check out the tips below and good hunting!

1. Get Ready for Home Ownership

Financing Your Purchase

- Check your credit score. It’s best to be at 700 and above

- Meet with/call your bank and get pre-approved for a mortgage. Next best thing is a pre-qualification letter from the bank

- Find out what type of mortgages you qualify for

Hire an attorney

- Hire an attorney who will review all contracts and agreements associated with the home-buying process

The Down Payment

- Save up for a down payment (typically 10-20% of property’s value; if FHA- qualified, then possibly less)

- Your savings should also cover closing costs which can include taxes, attorney’s fees, and transfer fees

- When estimating monthly homeowner costs, consider utilities, homeowner association assessments & fees and maintenance

2. Find a Real Estate Professional

- Get a referral from friends, family and work colleagues

- Ask the real estate professionals you interview about buyer’s representation contracts and agreements; make sure you understand the terms

- Explain your needs and expectations to the real estate professional you choose to work with

- Consider working with Anchor Realty and its experienced team. You'll benefit from world-class, personal service, hard-won expertise and in-depth island knowledge. Call Anchor Realty at (508) 696-7777 for more information.

3. Find the Right Property

- Determine what is important to you, such as area distance to amenities such as beaches, marina, and shops, schools, monthly mortgage payment, public transportation, walkability, etc.

- Make sure you include home owner’s assessments, utilities, and taxes when calculating the monthly mortgage payments

- Remember the 2% Land Bank fee, which is levied on all Martha’s Vineyard property sales, which will add $10,000 and up to your closing costs

4. Finance the Right Property

- Contact your mortgage broker or lender

- The lender or attorney will run a title search to ensure there are no clouds on the title

- Make sure you understand the financing terms – ask the lender for clarification, if needed

5. Make an Offer

The Offer

- Make sure the septic system, if applicable, has passed a recent inspection

- Acquire title insurance, usually taken care of by your lawyer

- If the title is not clear, make your offer contingent upon title clearance

- Read all contracts before signing—make sure you understand all of the terms, ask questions

- If your offer is not cash, you will have a mortgage contingency, and closing will take place approximately 60 days after offer acceptance

- Place a competitive bid and be prepared to make a counter-offer

- Keep your credit score stable and in-check by waiting to purchase any big-ticket items until long after the closing

- Only one offer will result in a sale, so be prepared to move on if your offer is not accepted

Offer Acceptance

- Once the offer is accepted, continue to work with your banker to complete the mortgage application, if applicable

- After the offer is accepted, plan on having the property inspected by a licensed home inspector within the next 14 days. If there are serious issues with the home, you can ask them to be remediated or have credit given by the seller at closing to cover your expenses to fix the issues

- After the offer is accepted, contact an insurance agent for homeowner’s insurance. Flood insurance may be required, depending on location

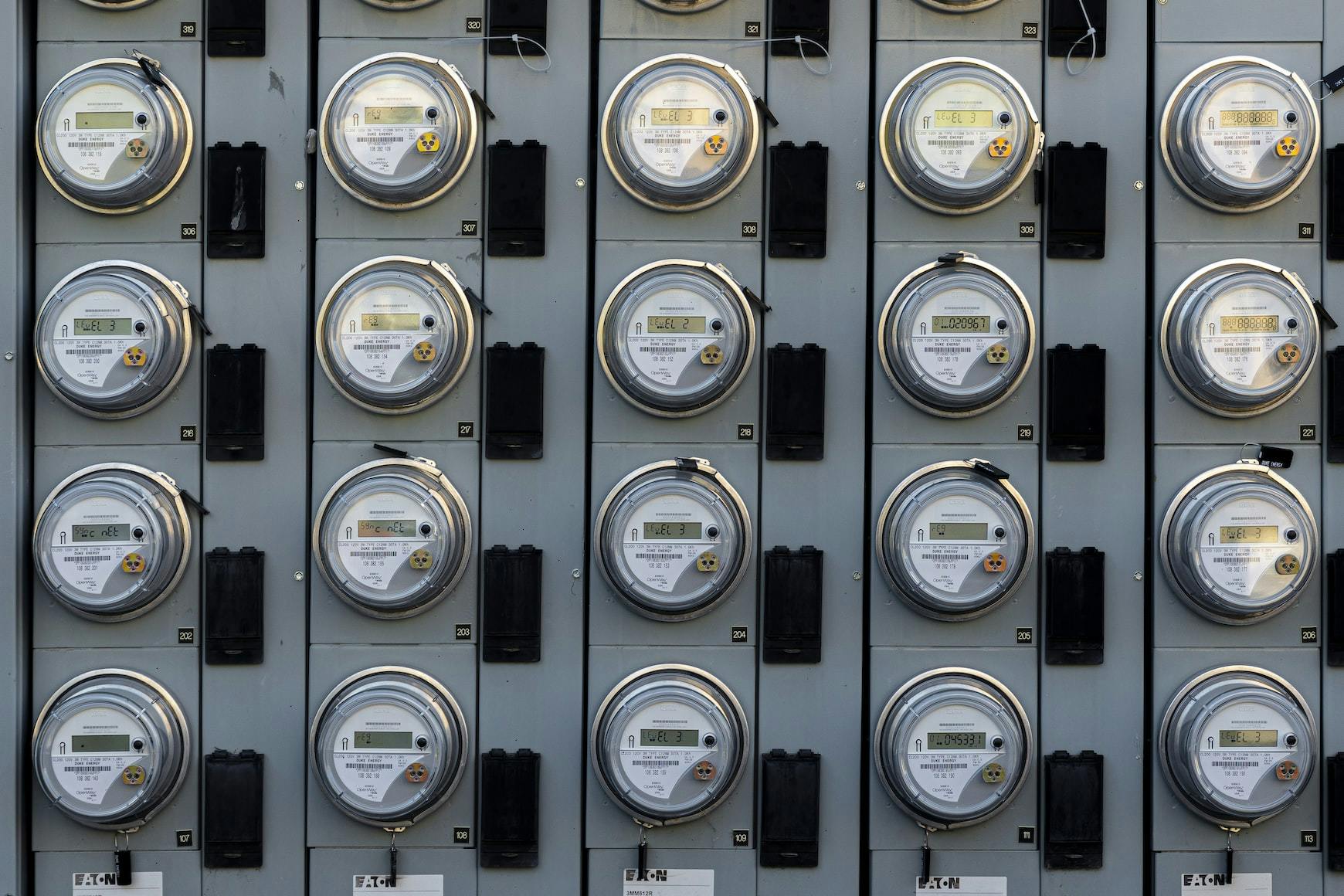

- Set up utility bills in your name, to take effect on Closing Day

6. Closing - Life After the Purchase

- Do an energy audit of your home, often offered by your utility company

- Weatherproof your new home

- Maintain files—digital or print—for all warranties, insurance documents, contracts, etc.

- Keep original closing documents in a safe place, preferably outside the home (such as a safety deposit box)

- Implement desired aesthetic changes, such as painting, minor construction, and re-flooring

- Set a move-in date and hire movers or plan a move party with your friends

- Get to know your neighbors and explore your new neighborhood

Things to Be Aware Of

Martha’s Vineyard is a very unique and wonderful place to live or own vacation property. However there are a few caveats to buying on the island that you should be aware of before making a move to purchase.

- Septic Systems Many of the homes in Martha’s Vineyard have a septic system for waste management. It is important to know that the size of this system directly correlates to the number of bedrooms allowed in a location, not to the number of bathrooms. Thus, while looking at properties keep in mind that the ability to add bedrooms onto the home or alter existing living space into additional bedrooms is dependent on the capacity of the septic system.

- When buying a home on Martha’s Vineyard, all purchases are subject to a 2% tax from the Martha’s Vineyard Land Bank Commission, which uses this money to help conserve and protect the island’s natural landscaping.

- In the town of Oak Bluffs, the attractive gingerbread cottages in the Campgrounds are wonderful summer cottages, however, if you’re looking to buy here you should be aware of the additional 2% tax on the purchase from the Camp Meeting Association. This tax goes on top of the 2% already being taken for the Land Bank.

Martha's Vineyard Mortgage Information

Below are some helpful links to banks on Martha’s Vineyard that can aid you with financial and mortgage planning.

For more information about obtaining a mortgage or our current listings, please contact us at today at (508) 696-7777.